Homestead Seminar in Chelmsford

Tomorrow (June 13, 2018) at 10:30 a.m. at the Chelmsford Senior Center, 75 Groton Road, North Chelmsford, I will present a free Homestead Seminar for anyone who is interested.

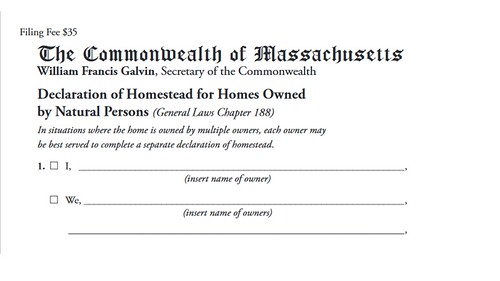

By filing a Declaration of Homestead at the Registry of Deeds, homeowners protect their homes from creditors. The process if simple: fill out the Homestead form, have your signature notarized, pay the $35 recording fee, and you’re done. At tomorrow’s Chelmsford event, I will have blank homestead forms for those wishing to obtain this protection. Just have your ID (so I can notarize your signature) and the $35 filing fee (either cash or check). I’ll bring the completed forms back to the Registry of Deeds and record them the same day.

If you can’t make the Chelmsford seminar, you can come to the Registry of Deeds (in the Middlesex Superior Courthouse) during normal business hours and complete the Homestead there, or you can download a copy from the Registry website and file it by mail.

Please note that if you are married and both spouses own the home, both must file the same Homestead.

To understand how the Homestead works, keep in mind that its purpose is to prevent families from being thrown out of their homes by creditors. It’s a protection that has been embedded in Massachusetts law for more than 100 years, most recently in Massachusetts General Laws chapter 188.

For most of us, our home is our most valuable asset. Creditors know this too, so if they sue and obtain a court judgment against you, their most likely target for collecting that debt is your home. A judgment against you can lead to the forced sale of your home with the proceeds used to pay down the debt. With a homestead, your primary residence (specifically, the first $500,000 in value of your home) is removed from the pool of assets that are exposed to a creditor. If you have a vacation home or a large stock portfolio, the creditor can grab them, just not your home.

The Homestead doesn’t protect against everything. You still have to pay your mortgage and your real estate taxes otherwise you could lose your home to foreclosure or a tax taking. Many people ask about the cost of nursing home care. If you’re a private pay patient and run up a big bill and then are sued, the Homestead would protect against that, but when most people refer to nursing home costs, they are talking about a Medicaid lien. Most people in nursing homes have their bill paid by the state Medicaid system. That will not touch your house as long as you or your spouse is alive, however, upon the death of the survivor, the state would have a lien on the house for the amount of care provided. The Homestead does not effect that.

If your home is in trust, you can still file a Homestead, although a different form is used for trust property. If you refinance your mortgage, there is no need to record a new Homestead. The Homestead lasts for as long as you own the property, and having one does no harm to your credit or your ability to sell or refinance.

Finally, the Homestead protects against debts that come into existence after the Homestead is filed, so don’t wait. To check whether you already have a Homestead, go to the Registry of Deeds website and search your name, or send me an email at DickHoweJr[at]gmail.com and I’ll check for you.